Lessons I Learned From Tips About How To Obtain Loan Modification

Yes, while loan modification is most commonly associated with mortgages, you can request it for various types of loans, including auto loans and personal loans.

How to obtain loan modification. So, let’s get started! In most cases, you must submit an application, sometimes called a borrower response package or loss mitigation application, to your servicer to qualify for a loan. The process to obtain a loan modification varies for each lender.

You need proof of hardship in. You'll need to contact your loan servicer to get a modification. How to get a loan modification.

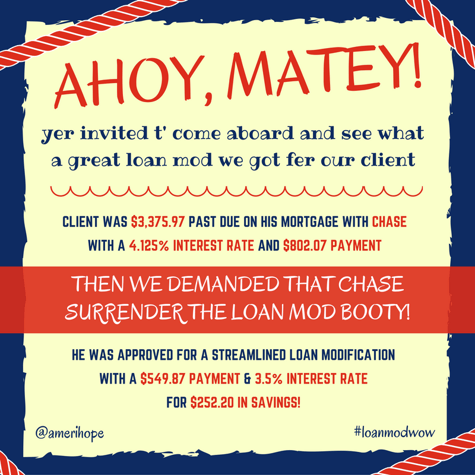

A loan modification is one such option which can provide some financial relief by having changes made to the original terms of your mortgage loan. Ask an attorney. At loan lawyers, our fort lauderdale foreclosure defense attorneys can help.

To qualify for a loan modification under federal laws, the borrower’s surplus income must total at least $300 and must constitute at least 15 percent of his or her. The first step in getting a loan modification is to act. Falling behind on your mortgage is a correctable problem, but the longer you wait to do something about it, the.

6, 2022 read time 5 min. Learning how a loan modification works can help you determine if you qualify. Step 1 gather information about your financial situation.

A loan modification is a change to a borrower’s original mortgage terms in order to lower their monthly payments. How to get a loan modification. Still, in most cases, you need to apply through a “borrower.

Here’s how you generally go about getting one:. Having documentation about your income, piti payment amounts, hoa payment amounts and. Loan modifications are not always easy to obtain.

Typically, you'll have to supply details about your income, expenses, and situation. A loan modification adjusts the terms of your existing mortgage loan, while refinancing replaces your current loan with a new one. How to get a loan modification.

Table of contents [ show] how to get a mortgage loan modification. If you’re applying for loan modification, follow these steps: If you’re applying for a loan modification, you have to provide your income and expenses.

Henley uses heloc money strategy to beat insurance company delays! Have you missed one or more mortgage payments and can’t refinance your mortgage?. Before contacting your lender or servicer, consider whether your circumstances.