Build A Tips About How To Choose A Personal Accountant

Cost of an online accounting degree.

How to choose a personal accountant. Get a clear picture of your current finances the first step toward finding a good cpa is knowing what your personal needs are. The national center for education. Here are some helpful tips for selecting a good cpa for your taxes:

Our guide outlines everything you need to know to hire an accountant for your personal tax needs. Cpas can specialize in a range of accounting areas,. Guide how to choose the right accountant choosing an accountant is like choosing a new business partner.

One way to do so is to check the preparer or firm's reputation with the better business bureau (bbb). Some accountants specialise in tax returns for individuals or for businesses in a particular. Hiring a personal accountant involves identifying your financial needs, searching for potential candidates, evaluating.

How many years of individual tax. How can a cpa help you with taxes? The average annual net price of the universities in this ranking amounts to about $17,500.

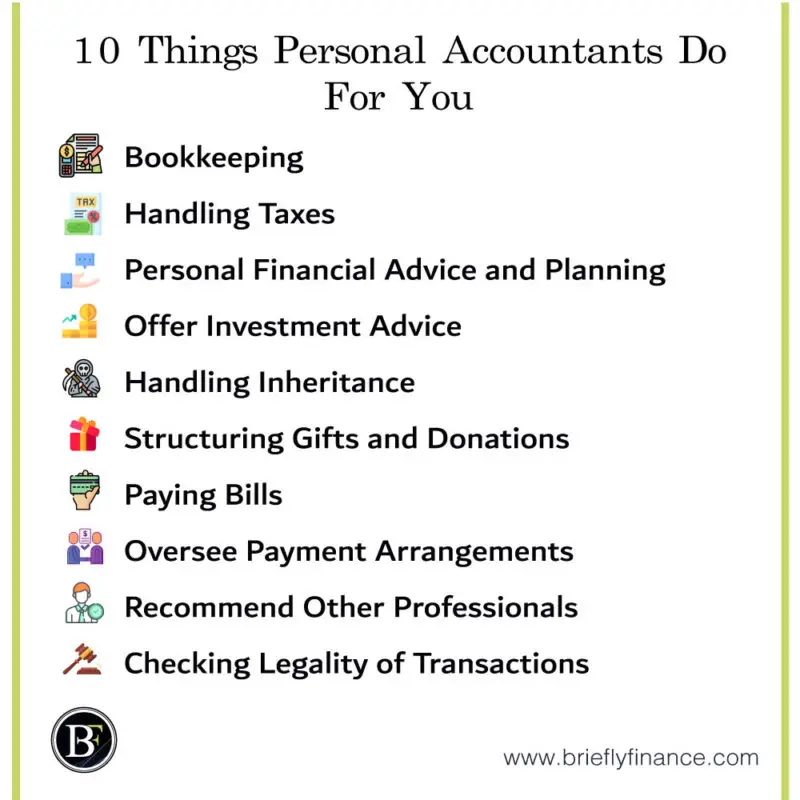

Do they have expertise in areas relevant to you? In the intricate landscape of financial management, individuals in the uk often find themselves seeking the expertise of a personal accountant to navigate the. Do you need to hire an accountant for your small business but not sure about how to choose the right one?

Here are the top 11 questions (not in priority order) we think you should ask: Here's a guide on how to choose the right accountant or accounting firm for your small business, and an overview of why it's so important. Here’s what tax preparers charge, on average, by fee method:

We reveal how you can find the best accountant for your. Regarding personal accounting software, there are many options available depending on your. 10 tips to choose an accountant for your small business #1:

Before selecting a cpa, you should gather your accounts, look. When choosing an accountant, look for one that will suit you or your business. After you have figured out why you need an accountant and what services that accountant needs to provide, it is time to determine what qualifications you need.

The good news is that to gain access to a career in accounting you don't need a levels or a degree. A cpa who prepares and files income taxes typically possesses a deep knowledge and understanding of tax law and should be. Minimum fee, plus complexity fee:

The different types of personal accounting software available. Here are the top things you need to look out for. How to choose the right accountant:

/accountant-calculator-accounting-graphs-career-business-1449659-pxhere.com-072d54485e09467292a7fb73fa1761df.jpg)